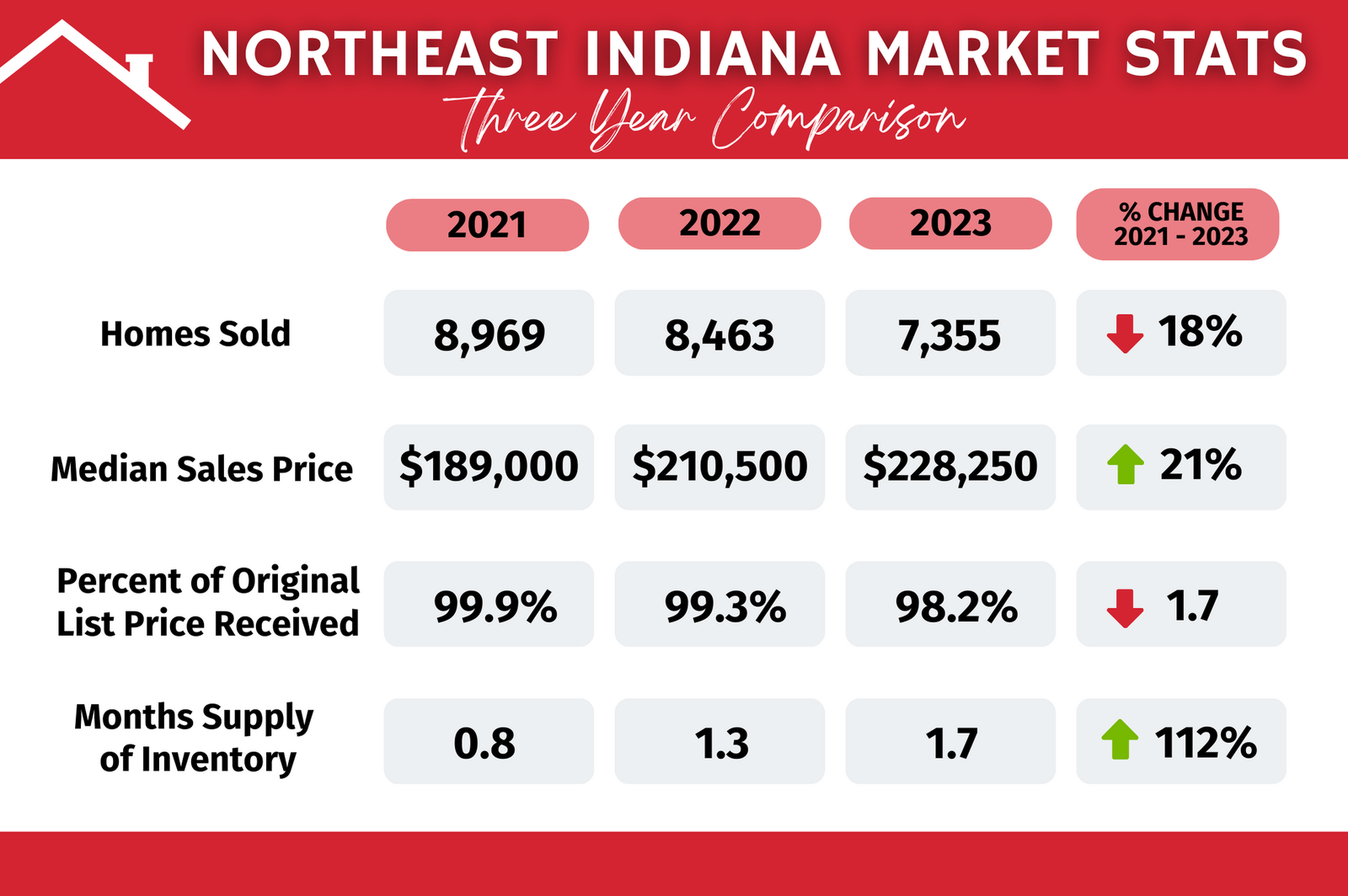

A quick look back at history can help give perspective and establish reasonable expectations for the future. So what can we expect in the local housing market for 2024?

• More existing home sales than in 2023. Local homeowners have gained more equity in their home value over the last five years than in any other decade. The Silver Tsunami is real and those 65 years and older have the equity to move forward while understanding they will pay a higher price for a smaller home because home prices have stabilized, but will not be lower.

• First-time buyer mortgage applications increase. The last three years of rising home prices discouraged many first-time home buyers and they paused when rates increased so quickly. The median age of a first-time home buyer has increased to 35. Fortunately, this group has secure employment and has done an excellent job-saving. While this demographic was squeezed out of the market when multiple offer situations and cash offers were common a couple of short years ago, they now have a solid opportunity to secure a home they can afford.

• The list-to-sales price ratio of home sales will remain steady at 97% to 99% of the list price. Few prognosticators point out this housing market indicator but northeast Indiana should note how solid our local economy is performing. While the number of sales was down last year, sellers still received 97% of the list price on average. Homes will be on the market slightly longer, but buyers and sellers can still expect a continued high list-to-sales price ratio.

If you would like to know what to expect in your neighborhood, please contact us. We value your business and continued referrals.